While DOGE (the Department of Government Efficiency) has made almost daily headlines pointing out fraud and waste in government, the real battle over federal spending is beginning to take place. From what has been proposed, it looks like it will be business as usual in Washington.

Last week, the full House of Representatives passed the House Budget Committee’s plan (budget resolution) which specifies cuts in both taxes and spending over the next decade. The key phrase here is “over the next decade.”

In a Feb. 13, 2025 Tax Foundation article titled “House Budget Resolution Aims to Balance Tax Cut and Spending Reduction Goals,” William McBride, explains that:

The resolution caps the deficit increase resulting from

tax cuts at $4.5 trillion over the next decade and requires

a minimum of $1.2 trillion in spending cuts. Additionally,

it sets as a goal to reduce mandatory spending by $2 trillion

over the next decade, and, if not accomplished, the cap on

tax cuts would be reduced commensurately. *

The resolution calls for certain committees to implement the cuts:

- Energy and Commerce Committee ($880 billion)

- Education and Workforce Committee ($330 billion)

- Agriculture Committee ($230 billion)

Programs that more than likely face budget reductions include: Medicaid, student loan relief, and the Supplemental Nutrition Program.

Despite Defense Secretary Pete Hegseth’s call for an 8% yearly cut in defense spending over the next five years, the current House resolution would increase defense spending by $100 billion. There is an additional increase of $230 billion for border control and “deportation plans to be executed” according to Brett Samuels of the political website The Hill, in an article he penned titled “Trump Backs House GOP Reconciliation Bill Over Senate Version.” **

Like Trump and most of his administration, Hegseth has sent conflicting signals on defense spending. While in Germany, the defense secretary said: “I think the US needs to spend more than the Biden administration was willing to, who historically under-invested in the capabilities of our military.”

Hegseth bombastically added that he wants “the biggest most badass military on the planet,” as quoted by Dave DeCamp of news and commentary website Antiwar.com in a Feb 2025 analysis. *** So much for an America first foreign policy.

The House’s estimate for spending and tax cuts are based on a real rate of growth of 2.6%. This optimistic forecast, of course, does not account for any downturn in the economy, war, or continued uptick in price inflation. Any of these, or some exogeneous shock to the economy would lower gross domestic product and tax revenues and jeopardize any long-term projected tax or spending cuts.

In the end, the budget resolution will increase spending, which Trump vowed to curb, as Rep. Thomas Massie (KY), who courageously voted against, succinctly summarized:

If the Republican plan passes under the rosiest

assumptions, which aren’t even true, we’re gonna

add $328 billion to the deficit this year, we’re gonna

add $295 billion to the deficit the year after that, and

$242 billion to the deficit after that. . . . ****

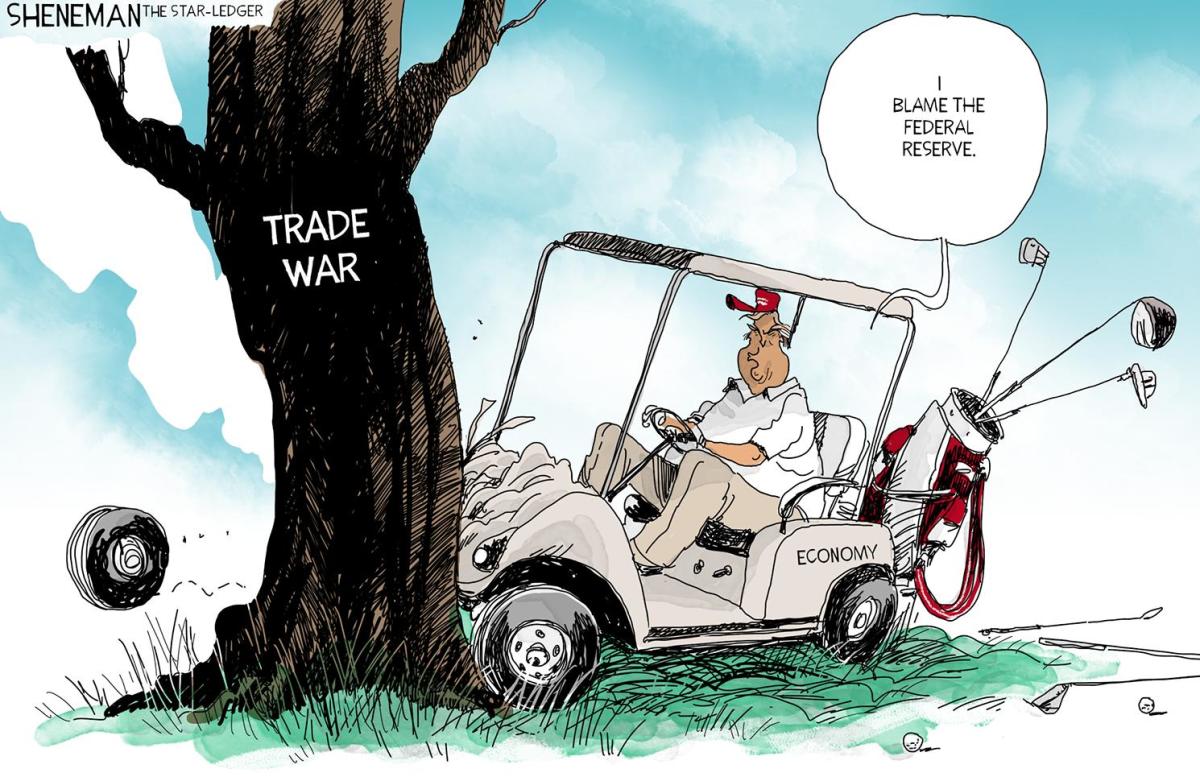

Trump, who enthusiastically supports the budget resolution, fails to realize that without deep and significant spending cuts, the cost of living will continue to escalate. The president blamed the Biden Administration’s policies for the run-up in prices, when, in fact, it was Trump who began the present inflation cycle with the passage of the CARES Act in 2020, expanding the budget an unimaginable $2.2 trillion.

Without spending cuts, the burgeoning federal deficit ($2 trillion) and the interest on the national debt ($1 trillion) will need to be continually financed through borrowing. The borrowing by the federal government is “paid for” through money printing (the real definition of inflation) by the Federal Reserve which buys U.S. debt with money “created out of thin air” which in essence is debt monetization. The new money puts pressure on prices as it filters through the economy increasing the cost of living.

While cuts in spending and reducing the amount of dollars in circulation will lower the cost of living, it will not come without severe economic pain. The fall in prices will pop the bubble that stocks and other financial assets have been in which will result in widespread unemployment and business failures. This is necessary to cleanse the malinvestment caused by the money printing and credit expansion and is necessary if America is to be put on a sound financial footing.

Of course, no politician wants to be blamed for such misery and even though Trump will not be up for re-election, he still does not want to be holding the bag when the economy implodes. Yet, if such a scenario happens, the president should bear much of the blame for his policies ignited the present problem.

If President Trump truly wants to make America great again, cutting government spending must be undertaken no matter how painful.

It appears, however, that he will join the long list of chief executives who have spent the nation into a horrific debt spiral which will inevitably end in economic ruin.

*William McBride, “House Budget Resolution Aims to Balance Tax Cut and Spending Reduction Goals,” Tax Foundation, 13 February 2025. https://taxfoundation.org/blog/house-budget-resolution-tax-cuts-spending/

**Brett Samuels, “Trump backs House GOP reconciliation bill over Senate version,” The Hill, 19 February 2025. https://thehill.com/homenews/administration/5152871-trump-endorses-house-gop-strategy/

***Dave DeCamp, “Pentagon Says Hegseth’s Order Will Redirect Spending, Not Make Actual Cuts,” Antiwar.com, 20 February 2025.

****Tyler Durden, “House Republicans Advance Trump Agenda as Final Vote Looms Tonight.” Zero Hedge, 25 February 2025, https://www.zerohedge.com/political/house-republicans-advance-trump-agenda-final-vote-looms-tonight

Antonius Aquinas@AntoniusAquinas

Harry Elmer Barnes

Harry Elmer Barnes