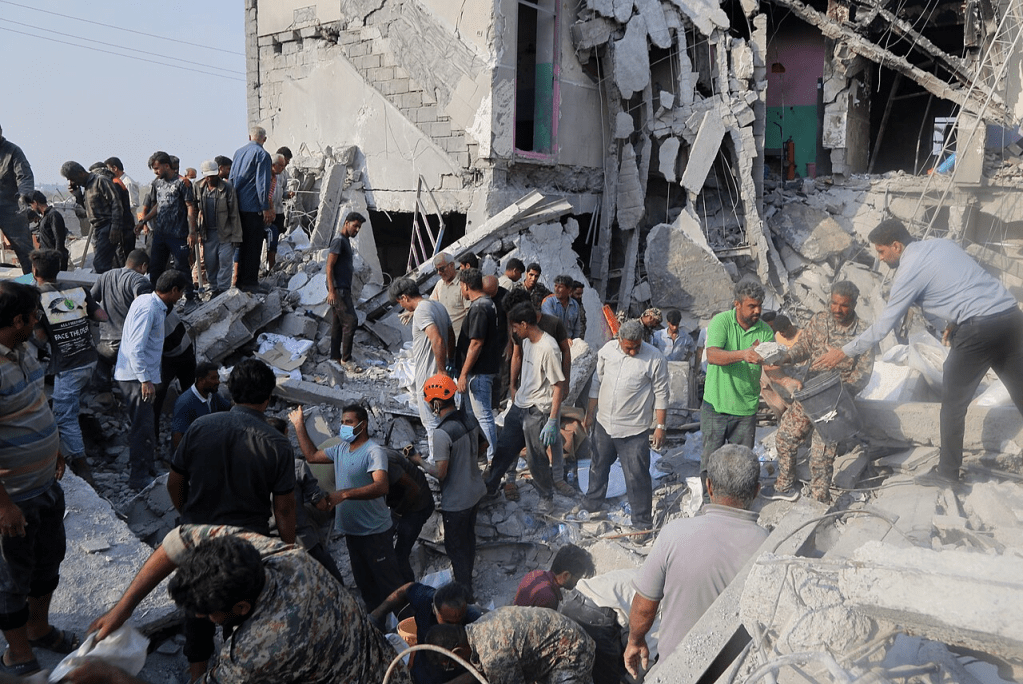

The U.S Destroys Iranian Girls’ School

It is ironic that the unprovoked U.S-Israeli attack on the Republic of Iran has taken place in 2026, the 250th anniversary of American independence. No doubt there will be grand celebrations thissummer for the American Revolution that brought the 13 colonies their freedom from England, However, the festivities planned may still be marred with the nation’s commuters paying $5-to-$10- per-gallon for gasoline. A more somber pall on the celebrations will be the honoring of the inevitable wounded and dead U.S. military personnel from the hostilities.

The duplicitous U.S.-Israeli attack was done, once again, under the cover of negotiations. They have at least a five-fold purpose:

- To assist Israeli prime minister Benjamin Netanyahu in fulfilling the long-held Zionist dream of Greater Israel – the absorption of all of Israel’s neighbors into one massive Israeli state. This “Greater Israel Project” necessitates the destruction of Iran;

- A payback to President Donald Trump’s Zionist donor class who financed his successful 2024 presidential election;

- To cut off another energy supplier to China;

- To continue to fill the coffers of the military industrial complex; and

- Another distraction from the Epstein files.

The war with Iran is another in a long, bloody and destructive series of repudiations of the spirit of America’s independence which the country’s founders contended was a struggle against empire and any type of aristocracy and/or monarchial quasi-religious oversight.

Seeing the level of government interference in the everyday lives of Americans, the level of taxation, and now Trump’s onerous tariffs, the amount of wealth confiscation and meddling that the English inflicted on its colonies was negligible compared to that of the Leviathan that resides on the shores of the Potomac River.

Independence from empire would prove fleeting and, within a decade, the confederacy of 13 independent states would lose almost all of their sovereignty to a powerful central government created under the U.S. Constitution. A once – decentralized political arrangement had been trashed and turned into a centralized nation state with an unchecked executive branch.

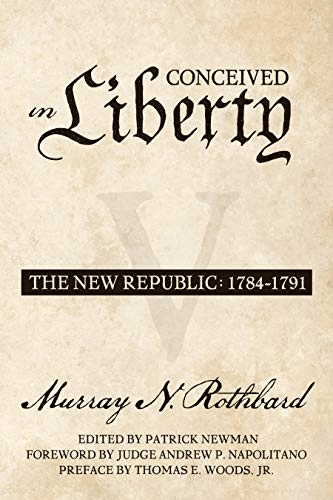

Murray Rothbard, in his five-volume history of the American Revolution, accurately described what took place in those tragic years between 1787 and 1789:

It was a bloodless coup d’etat against an unresisting

Confederation Congress. … The Federalists, by use of

propaganda, chicanery, fraud, malapportionment of

delegates, blackmail threats of secession and even

coercive laws, had managed to sustain enough delegates

to defy the wishes of the majority of the American people

and create a new Constitution. *

It would be difficult to argue that the history of the world would have been a more peaceful and prosperous place had America remained a country with a myriad of sovereign governing bodies. Furthermore, it is likely that such a political condition would have accelerated decentralization around the world.

Many libertarians and most anti-war podcasters still cannot see that the Constitution they so enthusiastically honor is the essence of the problem in U.S. foreign policy. Moreover, it was the explicit intention of the framers to create such a case. The idea of the Constitution as a limitation on state power or that its interpreters have misunderstood the intention of the founders is fallacious.

The political philosophy and understanding of the Constitution’s framers came mostly from antiquity, which glorified the state while they ignored the near millennium of European history after Rome’s fall which was a decentralized political order.

Basic political science has demonstrated that a multitude of political entities and jurisdictions are superior and conducive to both personal freedom and economic growth. Wars, too, that are fought under such conditions are limited in scope because the participants can only amass small amounts of resources and personnel from the populace. Vast states, like the United States, China, and Russia can tap seemingly untold amounts of men and resources, which will mean far more destructive conflicts.

It should be obvious that the solution to the nation’s interventionist foreign policy is one of political decentralization which, in America’s case, would mean a breakup of the nation into 50 (and hopefully more) political entities.

President Trump was the last hope (among most) to rein in the empire. Since he has the unlimited means to conduct wars as chief executive, it was only up to his personal integrity and discretion to abide by his campaign promises as the “peace president” to prevent future wars. Since Trump, like most politicians, is untrustworthy and a bald-faced propagandist, conflicts were inevitable. Finding the right man for the job in the future is futile as it is the system itself which is to blame.

Disengagement from the political process and the building of the ideological case for decentralization should be the path of America firsters, libertarians, and anti-war social media outlets. The secession of the American colonies from the British Empire 250 years ago should be the model for those who hope to stop the murderous foreign policy of the United States.

*Murray Rothbard, Conceived in Liberty. Vol. 5, The New Republic, 1784-1791, ed., Patrick Newman. Auburn, AL.: Mises Institute, 2019, p. 306.

Antonius Aquinas@antoniusaquinas

https://substack.com/@antoniusaquinas?

posted, eds. 3-12- ’26