Neo-Marxist Pope Francis

As the new year dawns, it seems the current occupant of St. Peter’s Chair will take on a new function which is outside the purview of the office that the Divine Founder of his institution had clearly mandated. Besides being a self proclaimed expert on global warming and a vociferous advocate of societal-wrecking mass immigration, it looks as if “Pope” Francis has entered the realm of global economics specifically, international monetary policy.

In an 18-page document issued through the Vatican’s Office of Justice and Peace, Bergoglio has called for, among other repressive and wealth-destructive measures, the establishment of a “supranational [monetary] authority” to oversee international monetary affairs:

In fact, one can see an emerging requirement for

a body that will carry out the functions of a kind of

‘central world bank’ that regulates the flow and system of

monetary exchanges similar to the national central

banks.*

The paper, “Towards Reforming the International Financial and Monetary Systems in the Context of a Global Public Authority,” contends that a world central bank is needed because institutions such as the IMF have failed to “stabilize world finance” and have not effectively regulated “the amount of credit risk taken on by the system.”

Naturally, as one of the planet’s preeminent social justice warriors, Bergoglio claims that if a world central bank is not commissioned, than the gap between rich and poor will be exacerbated even further:

If no solutions are found to the various forms of injustice,

the negative effects that will follow on the social,

political and economic level will be destined to create a

climate of growing hostility and even violence, and

ultimately undermine the very foundations of democratic

institutions, even the ones considered most solid.

Bergoglio acknowledges that if a central monetary authority is established it will mean a loss of sovereignty and independence among nations, but such “costs” are well worth the overall societal and economic gains:

Of course, this transformation will be made at the

cost of a gradual, balanced transfer of a part of each

nation’s powers to a world authority and to

regional authorities, but this is necessary at a time

when the dynamism of human society and the

economy and the progress of technology are transcending

borders, which are in fact already very eroded in a

globalized world.

While the document demonstrates that Bergoglio has not a clue of basic monetary theory, it shows again that the “pope” is a radical socialist who has more in common with the loony ideas of Karl Marx than he does with Roman Catholicism.

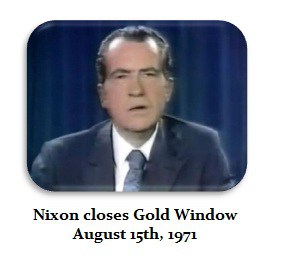

The ongoing and deepening financial crisis that Bergoglio seeks to address is not because there has been no global central bank to regulate more effectively the money and credit flow of the various nation states, but the crisis is because of the machinations of central banking. Central banking, through the fraudulent practice of fractional-reserve banking, has been the culprit in almost every financial calamity that has beset the Western world since the institution was first created.

If “Pope” Francis was truly interested in solving the financial crisis and alleviating the income gap between rich and poor, he would call for the abolition of this evil institution and advocate the re-establishment of an honest international monetary order based on gold and silver as money. But, as a good neo-Marxist, Francis is more concerned with the redistribution of wealth from rich to poor.

Yet, as sound economic theory has shown, this Leftist ideal is a scam. Redistribution of income never enhances the conditions of the poor but instead enriches the politically-connected elites and impoverishes the middle class.

Unlike what Bergoglio believes and what is taught in nearly all college and university economics classes, wealth can only be created by real savings (the abstention from consumption) and the investment of those savings into the production of capital goods which, in time, creates consumer goods. To foster such an environment, however, there must be a sound monetary order not open to manipulation via inflation and credit expansion by central banks.

As he has been accused by several of his cardinals for espousing heretical views on re-marriage and the reception of the Sacraments, “Pope” Francis’ position on international money and banking matters is equally erroneous. Jorge Bergoglio’s “pontificate” has been an unmitigated disaster plagued by constant scandal so it would be wise of him before it is too late to remember the ominous words of the Founder of the institution he now heads about the grizzly consequences that are in store for those who bring about scandal.

*Baxter Dmitry, “Vatican Calls for ‘Central World Bank’ and ‘Global Authority.'” Your News Wire.com 2 January 2017.

Antonius Aquinas@AntoniusAquinas