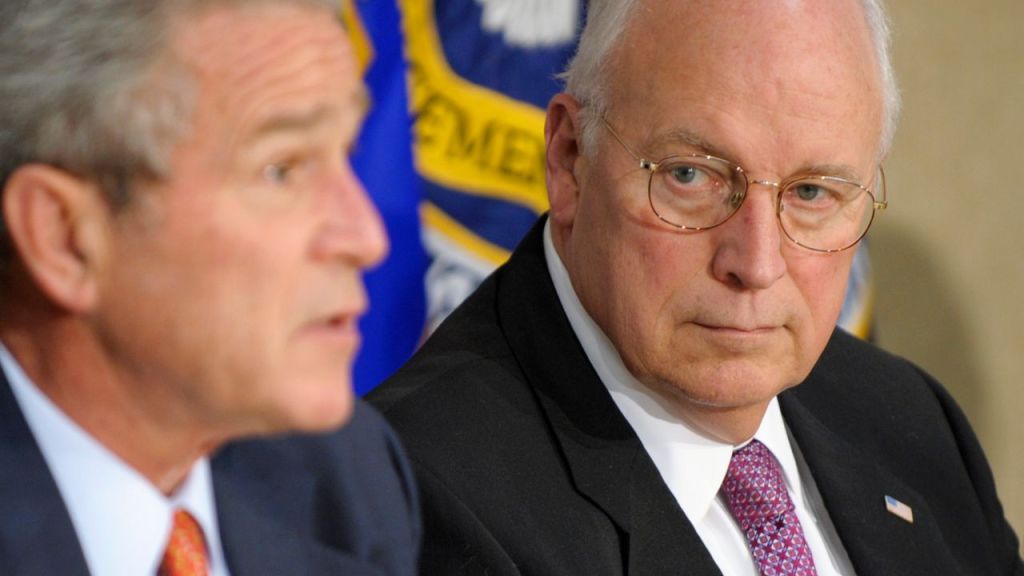

Former Vice President Richard “Dick” Cheney died on November 3, 2025 at the age of 84. As secretary of Defense under President George H.W. Bush, Cheney was the architect of the 1991 Persian Gulf War and later, as vice president under George W. Bush, he was instrumental in the invasion and eventual conquest of Iraq.

Brown University’s Cost of War Project has modestly estimated that the “wars on terror” have resulted in the deaths of more than 940,000 people including 432,000 civilians and a monetary cost to the United States of about $8 trillion.

Of course, Brown University’s study calls the post 9/11 U.S. military operations in the Middle East “wars on terror” when, in reality, they have been fought for the benefit of Israel and its Greater Israel Project, which has decimated the Arab world and has accomplished almost all of its objectives.

Cheney’s nefarious activities were not confined to mass murdering peoples that posed no threat to America’s national security. He was a force behind the U.S. policy of torture (waterboarding), and nearly unlimited domestic surveillance (the Orwellian-labeled Patriot Act).

According to an article on the news and commentary website “Antiwar,” headlined “Dick Cheney: The Dark Legacy of a War Criminal,” Cheney suggested U.S. intelligence agencies must: [O]perate on the ‘dark side,’ spend time in the shadows, and use ‘any means at our disposal’ to achieve its objectives.”

As if the U.S. Presidency was not unrestrained enough, Cheney advocated a “unitary executive” theory that the “president alone decides matters within the executive branch” without input from opposition voices within the government’s foreign policy agencies.

The response by libertarian and alternative media outlets to Cheney’s demise were universal in their denunciation of the former vice president, calling him a “war criminal” and that he left this world with a “dark legacy.”

It should be noted that a number of alternative media’s podcasters who have criticized Cheney regularly host guests and speakers who are former U.S. military and diplomatic personnel, ex-CIA agents and intelligence operatives, a number of whom participated in the Iraq wars and other American covert operations themselves.

Few, if any, who condemned the former vice president for his criminality mentioned or questioned why it was, and still is today, that monsters like Cheney were able to inflict so much death and destruction on peoples and nations across the globe who posed no threat to America.

Could it be that the political system that Cheney operated under was the problem? And, what is to be done to prevent future Cheneys from committing similar atrocities?

Unfortunately, “democratic” wars are paid for “by the people” and the costs are socialized among the population through taxation, inflation (money printing), and deficit financing. Since warmongering politicians do not have to directly pay for conflicts, there will be a tendency for them to be more bellicose. Moreover, democratic wars are collective enterprises where elected officials are not personally responsible for the actions of the government but are agents of the voters.

Nor have the supposed checks and balances of constitutional government, so often touted by admirers of the U.S. Constitution, been able to prevent conflicts, as the horrific record of American warmaking sadly proves.

The passage of the U.S. Constitution established a powerful central state which could (and did) tap the resources and men of the individual states to conduct wars which eventually took place the world over.

A weak national government, like that under the Articles of Confederation, or no central state at all, but instead a political order of numerous sovereigns (a world full of Switzerlands, Liechtensteins, etc.) would make warfare on a massive scale impossible.

Chip Gibbons, writing in the Jacobin magazine, called Cheney an “enemy of democracy whose agenda included war, indefinite detention, warrantless surveillance, and torture,” according to Alan Mosley. *

Cheney was not an enemy of democracy, but the product of a system that enables evil men to carry out the most heinous acts with little consequence, at least in this life.

Labeling Dick Cheney a war criminal will tarnish his legacy, but it will not alter America’s murderous foreign policy course. That will only come about when there is a recognition that the governing system itself needs to be abandoned and a decentralized political arrangement adopted.

*Alan Mosely, “Dick Cheney (1941-2025): The Dark Legacy of a War Criminal,” Antiwar.com, 5 November 2025. https://original.antiwar.com/Alan_Mosley/2025/11/04/dick-cheney-1941-2025-the-dark-legacy-of-a-war-criminal/

Antonius Aquinas@antoniusaquinas