A recent AARP poll provides further evidence of the deterioration of American living standards, especially for those approaching retirement age. The study contradicts what most policy makers have believed to be a “soft landing” for the economy after two years of rampant inflation.

“More than one quarter of U.S. adults over the age of 59,” the survey found, “say they expect to never retire.” One in four have no retirement savings while one third of “older adults” have credit card debt of more than $10,000 and 12% hold a balance of $20,000 or more.” The Headline of an April 25 Washington Times article by Fatima Hussein says it all: “More Than 25% of U.S. Adults Over 50 Expect Never to Retire.”*

Not surprisingly, the report conducted with the NORC Center for Public Affairs Research, points out that the lack of savings is due to the rising cost of living: “Everyday expenses and housing costs, including rent and mortgage payments, are the biggest reasons why people are unable to save for retirement.”

While AARP zeroed in on rising prices as the culprit for the financial pinch that potential retirees are feeling, it did not delve into who or what was the catalyst for the increase in living costs. Neither has the financial press, which has always been a cheerleader for the Uniparty, been diligent in its duty about the ultimate source for soaring prices.

While the trend of Americans working well into their retirement years has been going on for years, the situation has accelerated under both the Trump and Biden presidencies. In concert with the Federal Reserve, the fiscal policies of the two administrations have been the primary factor for why many Americans cannot retire.

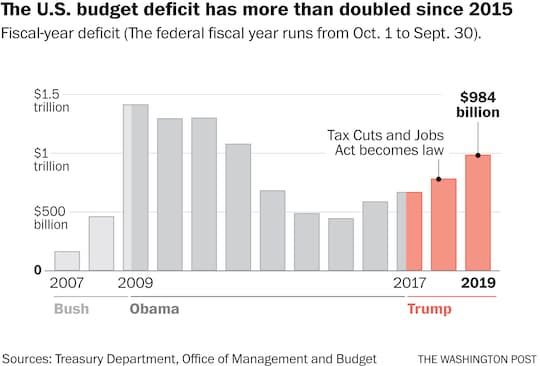

Even before the start of the hyped Covid pandemic, the Trump administration, in just one term, was on pace to become the biggest spender in U.S. history. The astronomical increase in government spending and money printing which took place in response to Covid are now being felt.

The Fed’s balance sheet before the Covid lockdowns in January of 2020 stood at $4.15 trillion. By the end of Trump’s presidency, it had nearly doubled to $7.3 trillion as the government doled out “stimulus checks” to non-working Americans and transferred billions to business favorites and cronies in an unimaginable grab of power and wealth.

Under Biden, the balance sheet had risen to a little short of $9 trillion in mid-2022 and has come down, now standing at $7.4 trillion, according to American Action Forum.**

Expanding the balance sheet means that the Fed issues more dollars it takes and buys assets (mostly government bonds). This is actually debt monetization. The increase in the money supply is the classic – and true – definition of inflation. Rising prices are not inflation, but its consequence.

At first, the new money went into financial assets increasing their nominal values. However, because of the “lag effect,” the inflation the Fed created is now pushing up consumer prices. The Fed has had to do this because of profligate government spending which must be sustained through borrowing, since tax revenues are not enough to meet expenditures.

When asked in his current re-election campaign on what he would do to solve the rising cost of living, Trump said that he would “drill baby drill.” Such a statement demonstrates again that the former president, like the current occupant of the office, does not understand the problem.

Increasing domestic oil production is certainly good in itself, which will create jobs and bring more oil to the market. But it will not address general price inflation which is a monetary phenomenon.

Rising prices can be reversed if the Fed increases interest rates, or better yet, lets rates be set by the market. Higher rates will entice people to save, which will take money out of circulation, thus putting downward pressure on prices.

Just as important, the government needs to cut spending and eliminate departments and programs which will mean less money printing by the Fed. The likelihood of this taking place in a presidential election year is next to zero.

Even if the government and the Fed took the proper steps and began to put the nation on a sound financial footing, it will take years for the damage that has been done to be rectified.

Sadly, the Uniparty has no intention of doing the right thing and as economic conditions worsen, the number of people who must work until they drop will continue to rise.

*Fatima Hussein, “More than 25% of U.S. adults over 50 expect never to retire.” The Washington Times, 25 April 2024, A7. **https://www.americanactionforum.org/insight/tracker-the-federal-reserves-balance-sheet/